31+ mortgage interest tax document

Mortgage interest and property taxes. Form 1098-MA shows any mortgage.

Calameo Ngh Wang Dolma S Ucc 1 Filing Online And With Return Register Mail Slip Ucc1 Orginal Filing Publish

Find The Correct Forms You Need to File Your Return.

. Ad Fill Sign Email IRS 1098 More Fillable Forms Register and Subscribe Now. Ad Shop a Wide Variety of Tax Forms from Top Brands at Staples. Web The primary borrower and co-borrowers of mortgage and home equity products can access their tax documents through Wells Fargo Online.

Its a tax form used by businesses and lenders to report mortgage interest paid to them of 600 or more. Web 1098 For most homeowners mortgage interest is tax-deductible and this document will tell you how much you paid last year. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Your lender is required to send you. For specific tax related questions however please. Available through online banking before January 31 2023 not accessible through the mobile app Paper copy mailed before January 31 2023.

Choose The Right TurboTax Product To Complete Your Taxes With Ease. Web If you have any questions about your mortgage loan end of year tax documents please contact us directly for assistance. Web 13 rows Instructions for Form 1098-C Contributions of Motor Vehicles Boats and Airplanes.

This information is general in nature is not complete and may. Web 2 days agoA 15-year fixed-rate mortgage with todays interest rate of 631 will cost 861 per month in principal and interest on a 100000 mortgage not including taxes. Web Box 2 on IRS Form 1098 Box 2 on IRS Form 1098 displays the principal balance of your loan as of January 1 2022 or when Chase acquired or originated the loan in 2022.

Web The Wells Fargo Tax Center and all information provided here are intended as a convenient source of tax information. Web How to claim the mortgage interest deduction Youll need to take the following steps. Student Loan Interest Statement Info Copy.

Ad Search Over Hundreds Of Tax Deductions w TurboTax To Maximize Your Tax Refund. HR Block Offers a Wide Range of Tax Prep Services to Help You Get Your Maximum Refund. Web The other three 1098 forms likely wont affect your taxes much.

For other Wells Fargo products only. For more detailed information about the Form 1098. 16 2017 then its tax-deductible on.

Look in your mailbox for Form 1098. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Your mortgage lender sends you.

Web IRS Form 1098 is a mortgage interest statement. Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now. Web Access your Form 1098 Mortgage Interest Statement online now by logging in and accessing the Document Center.

Web IRS Form 1098. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Staples Provides Custom Solutions to Help Organizations Achieve their Goals.

Ad Need Help Filing Your Tax Return. Web Is mortgage interest tax deductible.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

31 Statement Forms In Ms Word Pdf Excel

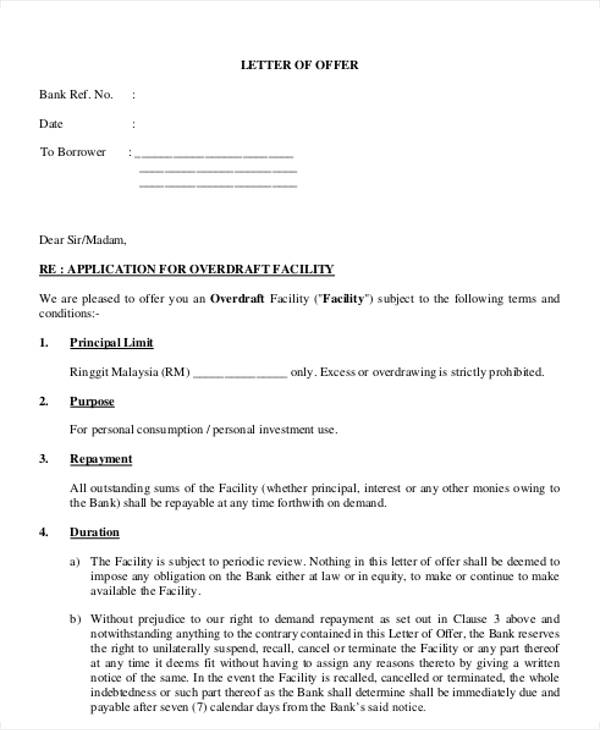

Loan Offer Letter Template 9 Free Word Pdf Format Download

Irs Form 1098 Mortgage Interest Statement Smartasset

Document

Ex 99 1

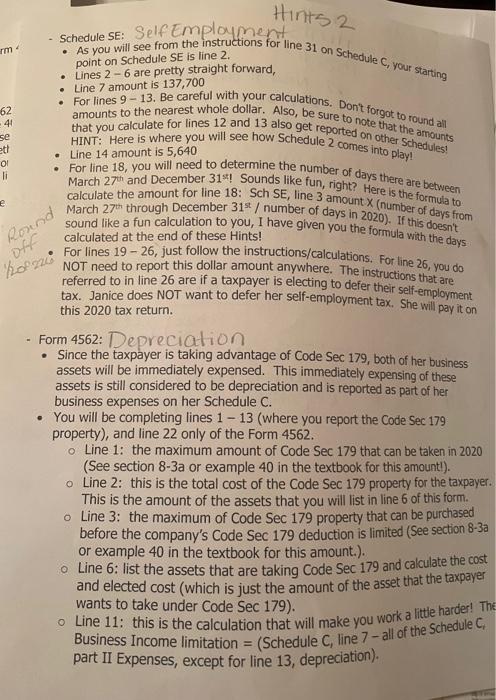

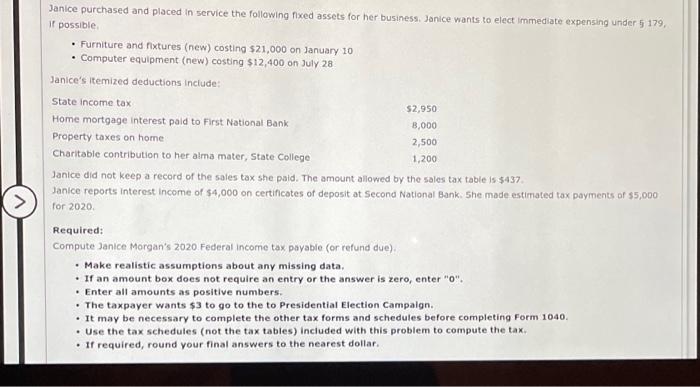

Solved All Listed Forms Will Be Used With An Agi Check Chegg Com

Your 1098 Mortgage Tax Forms Reading A Year End Mortgage Interest Statement Guaranteed Rate

Ex 99 1

Free 10 Property Tax Samples In Pdf Ms Word

Irs 1098 Mort E File Mortgage Interest Tax Form Today

Holiday Lets Allowable Costs And Capital Allowances

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Solved All Listed Forms Will Be Used With An Agi Check Chegg Com

Pdf Female Employment And Parental Leave The Case Of Poland

Form 1098 Tax Deductions New American Funding

Mortgage Interest Tax Deduction What You Need To Know